Price Action Reading: Candlestick Patterns: Characters combining to form words

In our last article (Price Action Reading: Candlestick the characters in the language of the market.), we discussed candlestick formations and their meaning. If you haven't read that article I would suggest you read that article first so that this topic will be easier to understand.

So now everyone knows and understands the characters so it is time to move on to words. Words are formed by combining characters together in any language and that holds true for Price Action as well. Here we combine two or three candle formations together to form a candlestick pattern that has some meaning. Whenever the market prints such patterns on screen we know what it is telling.

Two Candle Patterns

Engulfing Patterns

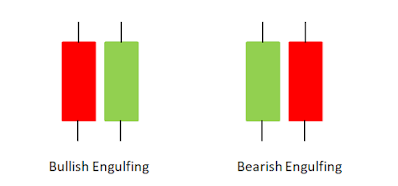

Engulfing pattern is said to be formed when a strong or weak directional candle is engulfed by an opposite direction candle.

Talking about the bullish engulfing pattern, here a bearish marubozu or bearish belt-hold candle is completely engulfed by a bullish marubozu or bullish belt-hold candle. That means the bearish candle was neutralized completely this is a strong bullish signal.

While for bearish engulfing patterns, a bullish marubozu or bullish belt-hold candle is completely engulfed by a bearish marubozu or bearish belt-hold candle. This suggests that the bullishness of the first candle was completely neutralized by the second candle hence it is a strong bearish signal.

Partial Engulfing Patterns

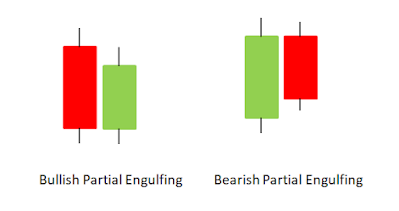

A partial engulfing pattern is said to be formed when a strong or weak directional candle is partially engulfed by the next candle in opposite direction.When a bearish marubozu or bearish belt-hold candle is partially engulfed by the next bullish marubozu or bullish belt-hold candle a bullish partial engulfing pattern is formed. Here as the bearish move is neutralized partially so the pattern is not considered strong but a weak bullish pattern.When a bullish marubozu or bullish belt-hold candle is partially engulfed by a bearish marubozu or bearish belt-hold candle the pattern formed is called a bearish partial engulfing pattern. As the bullish move is not completely neutralized this signal is considered to be a weak bearish one.Note: - The pattern can be considered to be a partial engulfing pattern only if the engulfing candle has engulfed more than 50% part of the previous candle.

- I do not recommend using such weak patterns for trading to newbies. The traders who have got enough experience backing their decision should only use such patterns.

- There are patterns named 'Harami Pattern', 'Piercing Pattern', and 'Twizzer Pattern' which has similar formations but got some special rules associated with them to be specified with these special names. I am not talking about them as they have a similar shape and similar meaning as well. If your intentions are to pass some examination then you may have to read about it but for people with non-financial backgrounds talking about them will only create the topic harder to remember.

Three Candle Patterns

Star Patterns

Morning star pattern formation is an extremely bullish signal here the pattern shows a clear step-by-step change of trend, the first candle is a bearish candle the second candle suggests equal strength of bulls and bears with a doji and the third candle engulfs the first two candles which suggest a clear trend change to bullish.While the evening star pattern is exactly opposite to the morning star suggesting a trend change from bullish to bearish.Inside Out Patterns

A three inside-up pattern forms when a bearish candle and an insider candle(a candle whose high and lows are within range of the previous candle) are completely engulfed by a bullish candle. Here the first candle denotes bearishness, the second one shows support from buyers but buyers are still not strong. The third candle completely engulfs both the candle absorbing all bearishness. This is a strong bullish signal.

A three inside-down candle forms when a bearish candle completely engulfs a bullish candle and an insider candle. The first candle shows bullishness while the insider candle shows the presence of sellers not letting prices surge but still not strong enough to push them down. The third candle engulfing all the bullishness gives a strong bearish signal.

These are a few most commonly used candlestick patterns if go on making such combinations the number of combinations will be too hard to remember and will not even benefit a real investor. If you have understood the way we combine candles together and find what they mean then remembering their names is of no importance. We just have to spot them and read them whenever they are printed on the screen.

So now, I will suggest you prepare a few of your own words(Candlestick Patterns) by combining characters(Individual Candles). Try to interpret their meaning and search the same words on the chart to see if the meaning you interpreted was right or wrong. This exercise will teach you a real lesson. With this let me take your leave for some time. We will talk about reading paragraphs in the next article. Do comment on your learnings and don't forget to READ TO LEARN INVESTING.

- The pattern can be considered to be a partial engulfing pattern only if the engulfing candle has engulfed more than 50% part of the previous candle.

- I do not recommend using such weak patterns for trading to newbies. The traders who have got enough experience backing their decision should only use such patterns.

- There are patterns named 'Harami Pattern', 'Piercing Pattern', and 'Twizzer Pattern' which has similar formations but got some special rules associated with them to be specified with these special names. I am not talking about them as they have a similar shape and similar meaning as well. If your intentions are to pass some examination then you may have to read about it but for people with non-financial backgrounds talking about them will only create the topic harder to remember.

Three Candle Patterns

Star Patterns

Morning star pattern formation is an extremely bullish signal here the pattern shows a clear step-by-step change of trend, the first candle is a bearish candle the second candle suggests equal strength of bulls and bears with a doji and the third candle engulfs the first two candles which suggest a clear trend change to bullish.

While the evening star pattern is exactly opposite to the morning star suggesting a trend change from bullish to bearish.

Inside Out Patterns

A three inside-up pattern forms when a bearish candle and an insider candle(a candle whose high and lows are within range of the previous candle) are completely engulfed by a bullish candle. Here the first candle denotes bearishness, the second one shows support from buyers but buyers are still not strong. The third candle completely engulfs both the candle absorbing all bearishness. This is a strong bullish signal.A three inside-down candle forms when a bearish candle completely engulfs a bullish candle and an insider candle. The first candle shows bullishness while the insider candle shows the presence of sellers not letting prices surge but still not strong enough to push them down. The third candle engulfing all the bullishness gives a strong bearish signal.

These are a few most commonly used candlestick patterns if go on making such combinations the number of combinations will be too hard to remember and will not even benefit a real investor. If you have understood the way we combine candles together and find what they mean then remembering their names is of no importance. We just have to spot them and read them whenever they are printed on the screen.

So now, I will suggest you prepare a few of your own words(Candlestick Patterns) by combining characters(Individual Candles). Try to interpret their meaning and search the same words on the chart to see if the meaning you interpreted was right or wrong. This exercise will teach you a real lesson.

With this let me take your leave for some time. We will talk about reading paragraphs in the next article.

Do comment on your learnings and don't forget to READ TO LEARN INVESTING.

Comments

Post a Comment

If you have any doubt please comment