Price Action Reading: Candlesticks the Characters in language of market.

Candlesticks :

Candlestick chart is the most commonly used price action chart and there is the reason for that. A candlestick chart shows you all important and noticeable data points for the time period under consideration. When you look at any single candlestick you will know the opening, closing, highest, and lowest prices for that duration.

Let's look at how a candlestick is formed considering daily time duration.

As soon as the market opens the price at which the first trade happens is noted. Similarly, the closing price is also noted and the highest and lowest prices during the day are also noted.

These noted prices are represented in a graphical format as shown in the image below. Note the point that if the opening price is lower than the closing price then the candle body is marked with green/blue color, while if the closing price is lower than the opening price the candle body is marked with red color.

Each candlestick printed on the screen has some meaning associated with it, it can be strong bullish, weak bullish, indecisive, strong bearish, or weak bearish. Strong Bullish:

Just imagine how a day dominated by buyers will look in an actual marketplace. The buyers will be willing to buy the underlying at any price they are getting while sellers would not be willing to sell at lower prices as buyers are easy to find in such conditions. So the prices will rise during the day and will end up close to the day high. It is possible that during the day sellers try to dominate the market but could not. This can be seen as a tail of candlestick such tail gives even more confidence in buyers as seller failed to overpower buyers even after trying.

Marubozu

Marubozu candle is one where buyers had clear domination. As soon as the market opened the buyers started buying heavily to raise the prices higher. While sellers could not do any noticeable move till the day end. The day was clearly dominated by buyers which is a strong bullish sign.

Green Hammer

Green hammer days are those where the sellers tried pushing prices lower initially but somehow buyers came in strongly and pushed the prices up beyond the price from where sellers had started selling. Even at that high price, where sellers initially sold heavily could not resist buyers, the candle closed green at the day high. This is also a strong bullish signal.

Weak Bullish

Now, let us talk about the day that was bullish but wasn't that strong.

What could happen on such a day?

Buyers will overpower but sellers will come in every now and then, buyers will again overpower while both of them will keep showing their presence buyers will overpower most of the time.

Such presence of power from both sides can be seen from shadows and overall bullish move shows stronger buyers.

Bullish Belt-hold

The bullish belt-hold candlestick shows a big green body suggesting buyers pushing the prices higher but somewhere there are a few sellers as well. These sellers did not let the market close at the high of the day. So the day was overall bullish but some selling was also present.

Hammer with Wick

A hammer with a wick pattern suggests that initially the market was bearish so prices were falling but somehow a strong buyer came in and bought so strongly that the prices rose beyond the opening price. Though the buyer was strong some sellers came in before the day's end and didn't let the price sustain at day high. The sellers were not strong enough to pull the prices lower enough to close near to the opening. So overall the day was bullish but there was the presence of sellers as well.

Indecision

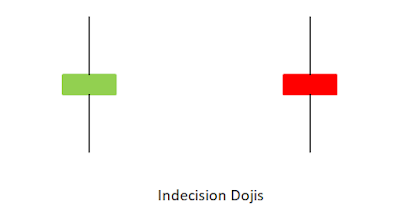

Now, let us look at a day when both buyers and sellers were in a conflict of power. Neither buyers could overpower sellers nor sellers could overpower buyers. On such days the buyers will come in as soon as price drops and sellers will come in as soon as the price rises. So the price will not sustain on either side will show a long wick and tail with a small body.

Indecision Doji

Indecision Doji are as shown in the above image long shadows on both sides suggest the presence of buyer at lower prices and presence of seller at higher prices with no real sense of direction. The color of the body is not given much importance as the body is small and mostly residing at the center portion of the shadow.

Strong Bearish

A strong bearish day is one when the sellers are so strong that the buyers could not raise the prices or even if they do so sellers immediately sold with even more strength and finally the prices closed near the day's low.

Bearish Marubozu

A bearish marubozu is the exact opposite of a bullish marubozu. Here sellers are so strong that buyers could not show any resistance to falling prices. The prices started falling as soon as the day started and kept falling throughout the day and finally closed near day's low. This shows strong bearishness in the market.

Shooting Star

A shooting star is the exact opposite of a green hammer. Here initially the buyer tried and raised the prices of stock but suddenly some strong sellers came in and prices started falling. Sellers were so strong that the prices fell below the opening price. The buyers could not support the market even there and finally market closed at day's low. This suggests strong bearishness in the market.

Weak Bearish

Weak bearish days are the ones when the sellers, as well as buyers, were active in the market but sellers were stronger than buyers. Such days show similar patterns as strong bearish patterns but they have small tails below the body. These tails suggest buyers supporting the market at lower prices but still sellers are strong.

Bearish Belt-hold

The bearish belt-hold pattern suggests that as the day started sellers started selling the stock with strength this caused the prices to fall sharply but somewhere between the day or at the end of the day some buyers supported the prices. This caused a tail to form at the lower end of the body but the buyers were not so strong that they could raise the prices considerably. So the day was overall bearish but some buying did happen at lower prices.

Shooting Star with a tail

A shooting star with a tail suggests that initially, the buyers were raising the prices buying but suddenly some strong sellers came into the market and sold heavily. This caused the prices to fall below the opening price. At those lower prices, some buyers again entered but they were not so strong to raise the prices considerably. The traces of buyers could be seen in the lower tail.

Above mentioned candlestick patterns are the most commonly known patterns. I tried my best to elaborate on the formation and reading of each pattern so that you will understand how to read any candlestick formed. If we try to find all possible formations it may get too complex but once you understand the logic behind reading the patterns you can easily read any formation on the chart and that is my intention so I have put this article in front of you.

I generally call candlesticks to be characters in the price chart. Once you get familiar with the characters we will move to words and their meaning in the next article. If you have any doubt please feel free to ask in the comment section and don't forget to READ TO LEARN INVESTING.

Comments

Post a Comment

If you have any doubt please comment